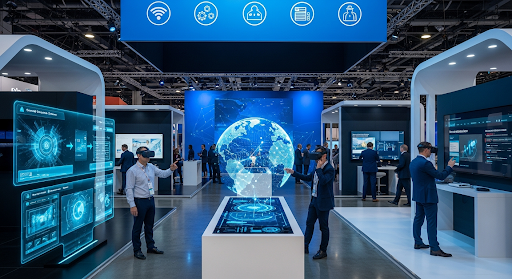

The financial services industry is evolving at an unprecedented pace, driven by advancements in technology, shifting consumer expectations, and the demand for seamless, secure, and innovative banking solutions. At the forefront of this transformation is the banking technology exhibition, where industry leaders, fintech innovators, and technology providers come together to showcase solutions that are reshaping modern banking.

These exhibitions provide a platform for exploring the latest trends, demonstrating real-world applications, and networking with key players in the financial ecosystem. For anyone looking to understand the future of finance, banking exhibitions are invaluable.

Digital Payments: Transforming Financial Transactions

One of the most significant trends highlighted in banking exhibitions is the evolution of digital payments. Consumers and businesses are increasingly shifting away from cash and traditional methods towards faster, more secure, and convenient alternatives. Mobile wallets, contactless payments, QR code-based transactions, and online payment gateways are transforming the way people interact with money.

Digital payment platforms offer real-time transaction processing, reduce errors, and provide enhanced security through encryption and authentication technologies. At leading banking technology exhibitions, attendees can experience these innovations firsthand, gaining insights into how they streamline operations and improve customer satisfaction.

Cloud Computing: Enabling Scalable Banking Solutions

Cloud computing is rapidly becoming the backbone of modern financial institutions. It provides banks with scalable infrastructure, data storage, and analytics capabilities that traditional IT systems cannot match. Cloud solutions enable banks to deploy new applications quickly, optimize operational costs, and enhance service reliability.

At banking exhibitions, cloud technologies are frequently showcased as critical enablers of digital transformation. They allow banks to innovate, reduce downtime, and ensure robust disaster recovery mechanisms while maintaining compliance with regulatory standards.

Fintech Innovation: Driving Industry Transformation

The role of fintech in reshaping banking cannot be overstated. Fintech startups are introducing AI-driven lending platforms, blockchain-based transaction verification systems, robo-advisors, and digital-only banks. Collaborations between traditional banks and fintech companies create an ecosystem that encourages innovation and enhances service delivery.

Banking exhibitions provide a platform to witness these collaborations in action. Attendees gain insight into how fintech innovations are integrated into traditional banking workflows, improving efficiency, customer experience, and risk management.

Cybersecurity: Safeguarding Digital Finance

As digital payments and cloud adoption expand, cybersecurity has become a top priority. Financial institutions are investing heavily in advanced security measures, including AI-driven fraud detection, biometric authentication, and blockchain technologies for secure transactions.

At leading banking technology exhibitions, cybersecurity solutions are highlighted to demonstrate how banks protect sensitive financial data while maintaining seamless customer interactions. These demonstrations provide valuable insights for IT teams, executives, and regulators on safeguarding digital finance.

Data Analytics: Turning Data Into Insights

Data is a critical asset in modern banking, and advanced data analytics allows institutions to transform raw information into actionable insights. Machine learning and artificial intelligence enable predictive analytics for credit scoring, fraud detection, and personalized financial products.

During banking exhibitions, attendees can explore the latest analytics tools that drive better decision-making. These solutions help banks identify trends, improve risk management, and deliver personalized offerings to enhance customer satisfaction.

RegTech: Simplifying Compliance

Regulatory technology, or RegTech, is revolutionizing compliance in the banking sector. Automation tools reduce the complexity of regulatory reporting, minimize human error, and help institutions stay compliant with evolving regulations.

At banking technology exhibitions, RegTech solutions are demonstrated to highlight their role in streamlining compliance processes. Institutions can reduce operational costs while focusing on innovation and growth.

Financial Inclusion and Sustainability

Digital banking solutions are extending financial services to underserved populations. Mobile banking, microloans, and digital identity verification tools are bridging gaps in traditional banking, ensuring equitable access to credit, savings, and insurance.

Banking exhibitions often showcase innovative solutions that promote financial inclusion and sustainability. These initiatives highlight the social impact of technology while opening new market opportunities for banks and fintech companies.

Enhancing Customer Experience

Modern banking places the customer at the center of all innovations. Omnichannel strategies, mobile applications, AI-driven chatbots, and personalized financial recommendations are redefining the banking experience.

Attendees at banking technology exhibitions can see live demonstrations of these tools, providing a firsthand look at how technology enhances customer engagement, loyalty, and overall satisfaction.

Embedded Finance: Expanding Beyond Traditional Banking

Embedded finance seamlessly integrates financial services into non-financial platforms like e-commerce, ride-sharing, and social media. This innovation enables consumers to access payments, loans, and insurance directly within the platforms they already use, creating a more convenient and unified experience. At banking exhibitions, such solutions are frequently showcased, highlighting how financial services are becoming increasingly integrated, accessible, and user-friendly.

By embedding finance into everyday applications, banks and fintechs enhance customer engagement, streamline transactions, and drive innovation across the digital financial ecosystem.

Digital Transformation: Cultural and Operational Change

Digital transformation in banking is not just about technology—it involves organizational culture, leadership, and strategy. Success depends on the ability to adopt new processes, train talent, and embrace innovative mindsets.

Banking technology exhibitions provide a platform for knowledge sharing, workshops, and thought leadership sessions. They help industry professionals understand how to implement change successfully while fostering collaboration across the financial ecosystem.

The Future of Banking Innovation

The future of banking is increasingly digital, interconnected, and customer-centric. Innovations in digital payments, cloud computing, fintech collaboration, cybersecurity, data analytics, RegTech, and embedded finance are transforming the industry. Banking technology exhibitions serve as key platforms, uniting stakeholders to showcase trends, share insights, foster collaboration, and highlight solutions that drive innovation, efficiency, and long-term growth in the financial sector.

Conclusion

The financial sector is evolving rapidly with digital payments, cloud adoption, fintech innovations, and advanced analytics. Banking exhibitions highlight these trends, offering insights into the latest technologies and strategies. By fostering collaboration and showcasing solutions, these events demonstrate how innovation is shaping more efficient, secure, and customer-focused banking.

World Financial Innovation Series (WFIS) – Indonesia provides a premier platform for banking and fintech leaders to explore innovations, network, and showcase solutions. Through their banking technology exhibition, WFIS connects industry experts, regulators, and solution providers, driving digital transformation, enhancing customer experiences, and fostering collaboration across the financial ecosystem. Experience the future of banking with WFIS – Indonesia.